Open up the banking stack

With banking stacks open, banks have more options to adapt fast to changing customer demands. Read more about tight stack integration and internal APIs.

Banks traditionally preferred to have tight control over their products and delivery channels, but today’s customers are increasingly looking for broader choices.

They want the banking products in the channel of their choice, at exactly the time they need it, and tailored to their personal preferences. This requires banks to open up their “banking stack” to third parties.

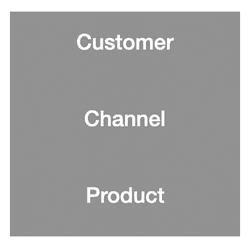

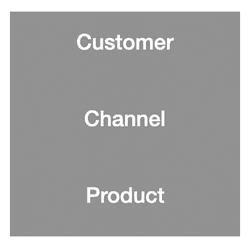

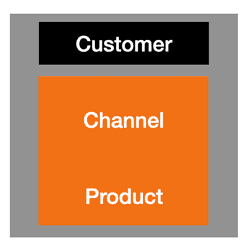

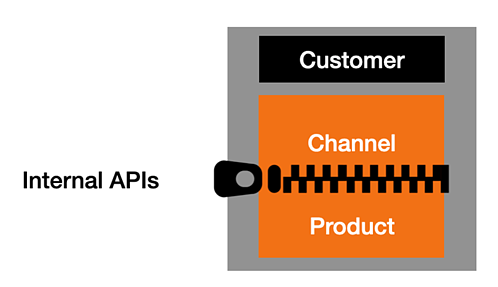

Banks typically organize around the concepts of products and channels, where products are things like as loans, accounts and payments. Channels are the delivery mechanism (such as mobile or web) of these products to the customer. This results in a simple three-tiered architecture.

Traditionally, banks follow a do-it-yourself approach, meaning that the bank both distributes and produces its services. This approach gives banks a tight control over their banking stack. In the figure below, we visualize the level of control, where orange is controlled by the bank, and black is outside its sphere of control.

Oftentimes, product and channel linked on an IT level (e.g. in a big monolith), but also tightly linked from a business perspective. Owning the channel gives control over the customer interface and allows banks to cross-sell products from their product portfolio. Owning the digital products, in addition to the channel, provides tight control of the value chain.

The downside to tight stack integration

But this tightly integrated banking stack has also disadvantages: Customers might feel that the product portfolio is too limited and wish for broader choice, e.g. in loans or mortgages. Customers might also see limitations in the capabilities of the channels – a more modern mobile app, personal financial management, personalized savings goals or account aggregation across the accounts of several of their banks.

Achieving these customer demands is not so easy in a tightly linked banking stack as the one shown above. In addition, using their DIY approach can be prohibitively expensive for banks trying provide the wide variety of special channels that customers want.

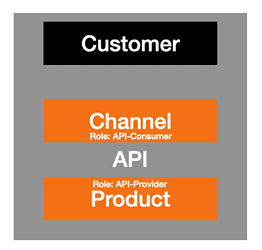

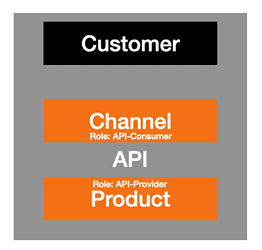

Banks renovate their IT system landscapes, and break up the monolithic structure into layers – channel and product – using internal APIs. The API is the mechanism for structuring the opaque banking stack into clear components with clear roles and responsibilities:

- The banking products are below the API and have the role of API providers.

- The banking channel sits above the APIs and has the role of an API consumer.

- The API sits between banking product and banking channel.

However, since these APIs are internal, they do not have any major effect on the business.

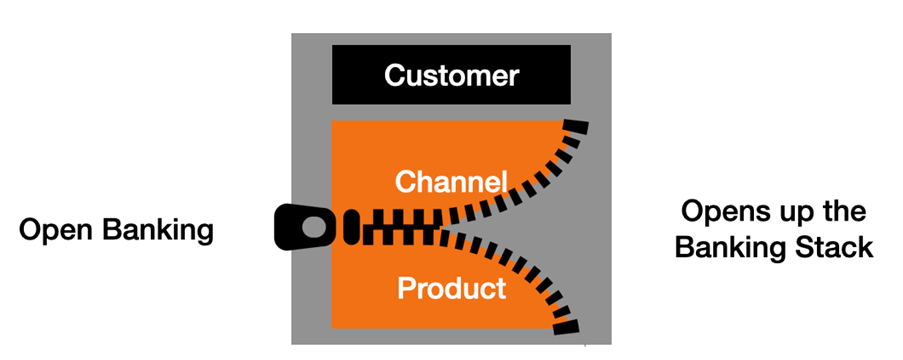

But open banking is not only an internal restructuring exercise, the structure is open, visible and accessible for other market participants outside the banks as well.

Open banking provides the legal and regulatory context for the APIs between channel and product to become visible externally. This in turn allows external players to contribute to the banking stack, which will have a major business implication. New business models become possible when the bank’s products can be distributed via third-party channels or when products of third parties can be easily distributed to own customers, maybe to fill a gap in the product portfolio.

With this structure and especially with the clear interface for the various components of the stack, banks can:

- Open up their stack and easily invite compatible solutions from third parties

- Easily integrate third-party solutions into the banking stack on both the channel side and product side

- Still develop their own banking products and distribute them via fintechs

- Or become the distributors of products and services created by fintechs.

Finding the optimal mix amongst these new options is now up to the strategy of the bank. But with their banking stacks open they have flexibility and a lot more options.

In my next blog, I will present the six strategy blueprints for open banking.

And feel free to check out my previous blogs:

Blog #1 Who wins in open banking?

Blog #2 How open banking ecosystems emerge