Customer loyalty – the new metric for success

Utilities will need business transformation and integration strategies in place before they can begin to command customer loyalty.

I recently came across a thought-provoking publication by Deloitte that outlined the evolution of the utility customer journey from rate payer to consumer to prosumer to transumer. My initial reaction was the authors really like the word play with “sumer.” My second reaction was one of skepticism.

Let me explain. According to Deloitte, the different types of customer journeys can be described as follows:

- Ratepayer – Uniform payment plans with a take-it-or-leave-it customer experience

- Consumer – Payment plans structured around electricity attributes and delivered with a smile

- Prosumer – Customers who both consume and sell back electricity to the utility

- Transumer – All of the above with the added ability of peer-to-peer electricity trading

The focus of the publication was on the proposition that the Transumer customer journey market model would be representative of the utility customer of the future. While it is a legitimate proposition, it is one I choose to disagree with.

As with any go-to-market strategy, one of the principal exercises that must be done is market sizing. Based on the same Deloitte study, it estimates that, by 2024, the five-year US outlook for customer-sited solar and battery plants generation will reach around 35 MW.

When you compare this 35 MW against a total installed US capacity of 1,100 GW, it represents only 3% of total generation. It seems to make better sense to concentrate on the balance of 97% customers who don’t have onsite solar or batteries.

Which is why I believe the more informed KPI metric would be customer “Net Promoter Score.”

In Europe: Loyalty and retention

For those of you not familiar with Net Promoter Score (NPS), it is an effectiveness metric used to measure customer experience programs. NPS measures the loyalty of customers to a company. The higher the score the better. NPS has become more important for European utilities. Why?

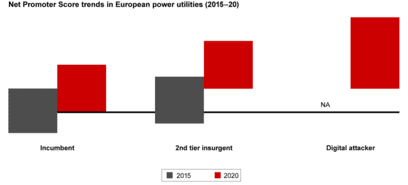

The European utility market is largely deregulated. As a result, it is highly competitive. A recent study by Bain & Company highlighted how insurgents have not only driven more competition, but as a result, focused on NPS initiatives to acquire and retain customers.

It is clear from the graph below is that both incumbent and challenger utilities see customer engagement via NPS investments as a central pillar in acquiring and retaining customers. The more important question is how do they achieve it?

Seamless Integration

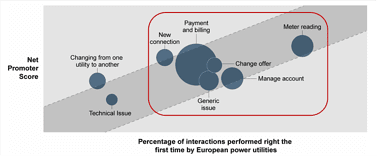

The same study published by Bain not only identified that investing in customer experience moves the needle on loyalty scores, but also showed that where and how they do it matters. For example, focusing investments on providing customers with single-step transactions increased the utility’s NPS. This analysis was captured in the following chart.

For each bubble in the chart, the higher the number of interactions captured by a single click, as measured on the X axis, the higher the resultant NPS as measured on the Y axis. Additionally, the key functions that have the largest impact – outlined within the red box – are those that are associated with new account set-ups, billing, new offerings and accurate meter reading.

To support NPS initiatives, two key technology capabilities are required.

- The ability to leverage process management platforms to provide a full suite of process capabilities to discover, monitor and continuously optimize all customer journey interactions that support NPS initiatives.

- The ability to integrate to data pools inside and outside their corporate firewall that support and enable one-click experiences.

To understand how Software AG support these two key capabilities, click below.