The process challenge of sustainable finance

Sustainability is a growing opportunity for financial services companies that truly commit to it. But to do it right, they need to embed sustainability in their processes.

Global warming, biodiversity under threat, exhaustion of resources, and social inequities. Sustainability is the challenge of the century, with both threats and opportunities to tackle at the same time. Take climate change and the transition to net-zero economies as an example – the impact on financial services companies is huge. The World Economic Forum estimates that $4-5 trillion of global clean energy investments are required annually by 2030. Sustainability impacts the financing divisions of banks (loans, bonds), the Properties & Casualties (P&C) divisions of insurers, and the investment divisions (wealth management) in both industries.

Financial Institutions across the globe are already making their first steps – but there is more to be done. In its 2021 Climate Biennial Exploratory Scenario (CBES), the Bank of England stated that UK banks and insurers still need to do much more to understand and manage their exposure to climate risk. Even worse – climate risks are likely to create an annual drag on profits of around 10-15% on average for banks and insurers, particularly if they are unable to manage these risks effectively. For example, the risks in the life and health insurance business are rising because of changing environmental conditions that have negative impacts on people’s health.

The path of least resistance is to approach sustainable finance as a cost reduction or risk mitigation method, but this is risky business. Instead, the goal should be to implement a truly new business model with new products, services, and processes. Taking a piece-by-piece approach to improvement, driven by the need to reduce risks and/or satisfy single regulations or investors is not a viable long-term strategy. Throwing bodies and budget at connecting systems and data sources to feed ESG data into risk management and reporting systems is an approach that doesn’t scale and is costly and challenging to maintain. These approaches leave financial services companies vulnerable in a fast-moving, competitive market.

The consequences are multifaceted: from loss of revenue and market share to more agile competitors to reputational risks including accusations of greenwashing.

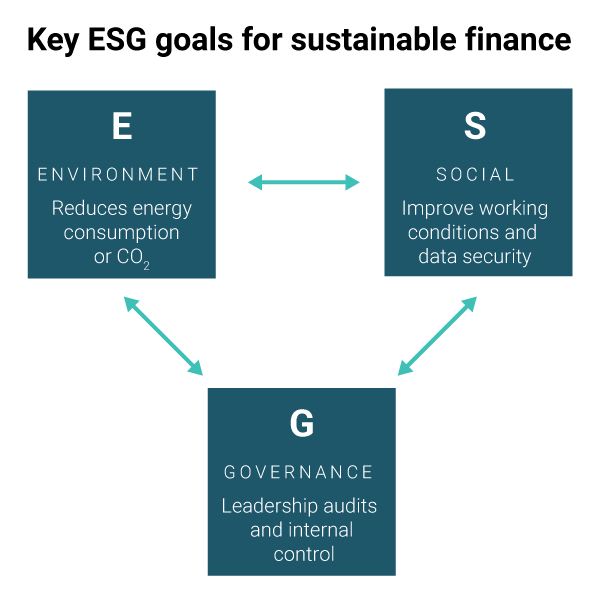

Defining a sustainable finance strategy is typically the first step for a bank or insurer to embark on the sustainability journey. This typically includes defining ESG criteria (i.e., a set of standards for the organization’s behavior in the three areas: environment, social, and governance).

- Environment criteria may include the energy consumption of the organization or the CO2 emissions of a customer or an investment.

- Social criteria consider relationships with employees, customers, and partners regarding working conditions, privacy & data security, etc.

- Governance criteria may consider the company’s leadership, audits, and internal controls. These ESG criteria have an impact on processes and data.

No matter what the criteria are, processes are the backbone of a sustainability strategy because they enable sustainable operations. And data is required to manage risk, enable sustainable products, and support reporting.

The importance of process excellence

A winning approach to sustainable finance begins with your processes.

How do you make sure that you have an adequate understanding of your current business model and your business operations? How do you transition to a future business model that is more sustainable (i.e., more resilient to climate-related risks and considers higher social and governance standards)? And more importantly, how do you truly embed sustainable finance into your business processes?

It could work like this: you choose an enterprise management system that becomes your single source of truth for your sustainability guide to strategy and operations. This system covers the four major phases of the transformation towards sustainable finance:

- The Assess phase: assess the current maturity of the organization, analyze the materiality to find out which issues matter most, and define a baseline strategy.

- The Build Strategy phase: develop a robust sustainability strategy that maps your sustainability mission and vision. This strategy includes initiatives and KPIs.

- The Operationalize phase: implement & roll-out required changes on a process level. This makes it possible for employees to follow the rules and guidelines in their day-to-day operations.

- The Track & Report phase: ensure compliance with the sustainability guidelines by constantly tracking processes and reporting on the transformation progress.

This means you would be able to develop a robust sustainable finance strategy that is in line with the corporate strategy. You would be able to ensure that employees learn about and understand the changes on a process level, linked to the day-to-day operations. And you would be able to ensure accountability and compliance through tracking process execution. Finally, you would be able to report on the progress of initiatives and prove progress to create stakeholder trust.

Finding a solution to help

While this is possible with any capable enterprise management system, it can be difficult to get started. And when it comes to the needs for sustainable finance today, a steep learning curve can be your worst enemy.

The recently introduced ARIS for sustainability is an accelerator package that delivers templates and sustainability-related content that helps you get an overview to jump-start your sustainable finance initiatives. It includes templates for materiality assessments, sustainability dashboards, non-financial reports, and much, much more. Learn more about ARIS and how it can help your organization implementing sustainable finance here.

In the next part of this sustainable finance miniseries, we will focus on the challenges related to ESG data.